Tink - Fintech Europe

Tink

Tink.com is a European open-banking platform. Founded in 2012,

the company is headquartered in Stockholm, Sweden. Tink operates in the area of

open banking. This means that the platform connects different banks and

financial service providers. Banks across Europe are connected through a single

API to provide the best financial data. The mission of this portal is to change

the European banking industry for the better.

Tink partners up with more than 2500 banks and institutions.

Main Tink's partners include PayPal, Klarna, BNP Paribas, ABN Amro, Nordea, and

many more. A fascinating 10+ billion dollars are processed through the portal

each year.

The market segment Tink is targeting are businesses of different

sizes. Their clients can either be large banks or even growing FinTech

companies. Any company that is looking to provide financial services to their

consumers can make use of Tink's resources.

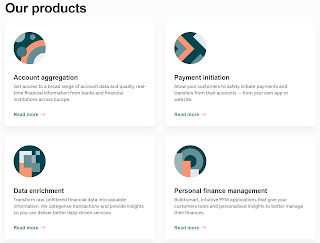

This open-banking platform focuses on four main services. These

are payment initiation, account aggregation, data enrichment, and personal

finance management.

|

| Tink services |

Account aggregation is developed through a partnership with ABNAmro. This Dutch bank partnered with Tink to provide personal finance

management app called Grip for their customers. Through the app, customers can

see the information from their different banking accounts on one screen.

Payment initiation services can be performed through a Lunar

mobile banking app. This Danish bank enables its clients to initiate payments

from their different banking accounts, through a single app. This way, the app

is a one-stop-shop for all banking transactions for the consumer.

Data enrichment is performed through the SEB banking app. This

app is developed through the Tink platform. It enables the customers to see

their banking transactions in a clear and organized way. This app is one of the

most popular channels in Sweden, with more than 200 million visits per year.

One more successful use of Tink's resources is CGD's DABOX app.

This Portuguese bank built an app to enable its consumers to manage their

finances more effectively. Valuable information is presented through the app.

Statistics, accounts, savings goals and many more are presented, to provide

great customer experience.

What's great about Tink's platform is that it can be used by

businesses of all sizes. Large banks, FinTech companies, comparison platforms or even small startups

can use their resources to provide seamless financial services.

The technology behind the portal is quite simple and

straight-through. Through a single API, companies access the information.

Everything is Cloud-based and built on the latest technologies. Also, the

company follows strict data protection rules under the PSD2 directive. This

means that Tink's clients can operate under their PSD2 license, and don't need

to get their own. Isn't that great? It helps their clients save precious time

and money.

Cloud-based technology, API connectivity, and SDKs make the

integration smooth and simple. There is no need for expensive integrations. This

is why Tink.com is a beneficial platform for any company looking to offer

financial services. Whether it is building the new financial service or

enriching the existing one, Tink can be a valuable partner.

Comments

Post a Comment